Our Legal Assets Platform

Litigation Finance:

The Ultimate Uncorrelated Asset

At Syz Capital, we view Legal Assets as a one-of-a-kind global asset class, offering the potential to deliver uncorrelated returns across diverse risk and return profiles. This innovative asset class provides investors with a powerful tool to diversify their portfolios, mitigate market exposure, and capitalize on opportunities independent of traditional economic cycles.

Global Platform

Institutional Underwriting

Proprietary Access

Zero Correlation

Investment returns are driven by legal merits – not by financial markets or economic developments.

Equity-like Returns

Automatic Exit

All-weather Returns

Litigation finance stands apart as one of the most compelling asset classes in today’s market. Its performance is driven solely by legal case outcomes, independent of economic cycles, interest rates, equity markets, or geopolitical shifts. This unique return profile offers exceptional risk-reward potential delivering uncorrelated returns that remain resilient in any market environment.

Litigation Finance

Themis Program

Our flagship litigation finance program, Themis, offers unique investment opportunities by strategically co-investing in legal proceedings through direct and secondary transactions.

This approach enables us to build a highly diversified portfolio of uncorrelated investments, designed to deliver consistent returns for our investors.

Themis invests across a broad spectrum, including both single and collective litigation, as well as arbitration, spanning various claim types and jurisdictions.

To date, Themis Fund I has successfully invested in

106 Cases

14 Jurisdictions

33 Claim Types

demonstrating our global reach and expertise.

Case Studies

Ride-Hailing Platform Class Action

(Australia, 2014–2017)

Taxi and hire-car drivers alleged losses following the launch of a low-cost service. Resolved via a $271.8m settlement, among the largest class actions in Australia.

Hearing-Protection Litigation

U.S. military veterans alleged defects in earplugs. After extensive litigation and appeals, the manufacturer agreed to a $6bn global settlement in 2023.

Audit Negligence Claim

Liquidators of a major construction/services group alleged negligent audits (2014–2016). The audit firm reached a confidential settlement in early 2023, resolving a £1.3bn claim.

Global Anti-Bribery Resolutions

A multinational aerospace company resolved investigations into the use of intermediaries in aircraft sales with coordinated settlements totaling €3.6bn in 2020.

Legal Credit

Think Private Debt. Revisited.

Secured Financing for Law Firms and Corporates with Attractive, Uncorrelated Returns.

Hera Program

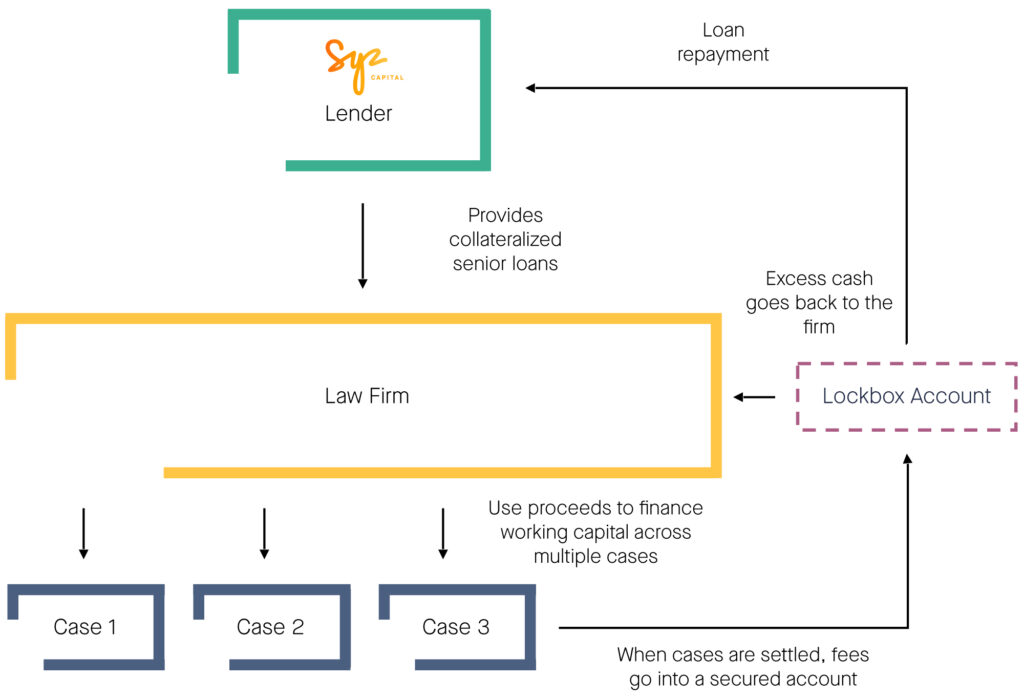

Syz Capital offers recourse financing to law firms and corporates, leveraging the power of portfolios of claims and legal receivables to deliver tailored investment opportunities.

Our Hera platform gives investors exclusive access to senior secured loans provided to well-established plaintiff-side law firms that represent individuals and consumers on a success-fee basis.

Every loan is backed by a diverse portfolio of cases, structured with conservative loan-to-value (LTV) ratios and maturities under 5 years, ensuring a strong risk-adjusted return profile.

This specialized segment of the direct lending market provides attractive yield spreads with minimal correlation to traditional assets, offering a powerful tool for diversifying investor portfolios. To date, Hera has predominantly invested in loans to US mass tort law firms, showcasing our deep expertise in this niche yet highly lucrative market.

Hera Fund I metrics

18.6% Avg. Interest Rate

17% Avg. Loan Ownership

+70 Distinct Collective Litigation

demonstrating our global reach and expertise.

Meet Our Experts

Olivier Maurice

Deputy CEO & Managing Partner

Legal Assets

Olivier Maurice

Prior to co-founding Syz Capital, Olivier was Head of Business Development and a member of the Executive and Investment Committees at ACE & Company, where he contributed to the rapid growth of the business. Prior to that, Olivier was a Partner at Brennus Asset Management, a fund investing in European convertible bonds and other equity-linked credit instruments. Previously, Olivier worked as senior analyst for Signet Capital Management in London, where he oversaw the European alternative fund portfolio. Olivier started his career in audit at KPMG, then wealth management at Société Générale in Switzerland.

Olivier holds a Master of Science in Management from HEC Lausanne, and a MBA from INSEAD. He is also a CFA charterholder.