With 200+ years of family business expertise we leverage our experience in private equity to unlock value across market cycles. Our strategy? Drive exceptional performance by identifying and investing in growth opportunities within the real economy.

Rooted in tradition, we proudly partner with family businesses and visionary entrepreneurs, empowering them to scale and succeed. Together, we turn growth ambitions into tangible results.

Resilient end markets: With favorable macro trends (logistics, healthcare, business & IT services, industrial services, defense) and consolidation potential

Established companies: With high cash conversion (>75%) in the B2B sector (>20% margin)

Family / Management owned: Primary situations where the owner is looking for a succession or growth partner

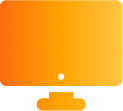

Opportunities to acquire majority: Acquiring majority rights and control from current owner(s). Easily identifiable appetite from strategic buyers or private equity investors, targeting >3x MOIC

We specialize in investing in thriving family-owned and founder-led businesses within stable, high-growth markets. With an entrepreneurial mindset, we collaborate as equal partners with founders and management teams, providing the expertise, resources, and guidance needed to accelerate their growth journeys.

For our investors, we offer a unique platform to participate in direct private equity transactions alongside us – sharing both risk and reward as true partners. Backed by the strength of a well-capitalized banking group, we deliver swift, decisive action and expertly structured solutions, even for the most complex deals – proven by our extensive track record of success.

We seek companies with robust cash flows and untapped potential, partnering with visionary leaders or successors to elevate their businesses to the next level.

Leading provider of online marketing services with a distinctive success-based pricing model, complemented by their proprietary tracking and analytics tool.

Investment Date: 2023

Website: www.cptr.com

SK Pharma offers advanced supply chain solutions for the healthcare industry, such as warehousing, packaging and order to cash management solutions.

Investment Date: 2022

Website: www.sk-pharma-logistics.de

SINWA Global is Asia’s leading provider of marine, offshore supply, and logistics services, offering a comprehensive range of supply, catering, offshore support, and logistics solutions.

Investment Date: 2019

Website: www.sinwaglobal.com

True long-term growth isn’t just about chasing gains – it’s about preserving value. Our approach prioritizes robust downside protection, ensuring stability while setting the stage for sustained success.

We invest in high-potential small and mid-cap companies with untapped strategic and operational opportunities. By fostering organic growth and enabling transformative acquisitions, we help these businesses thrive.

Our value-oriented investments target thriving family-owned and founder-led businesses in stable markets. Leveraging four critical drivers – operational excellence, organic growth, buy-and-build strategies, and margin enhancements – we position companies for enduring success and market leadership.

Our program is designed to deliver outsized returns by investing in a diverse range of high-performing private equity opportunities. Partnering with top-tier, specialized teams, we leverage their deep expertise to maximize value creation.

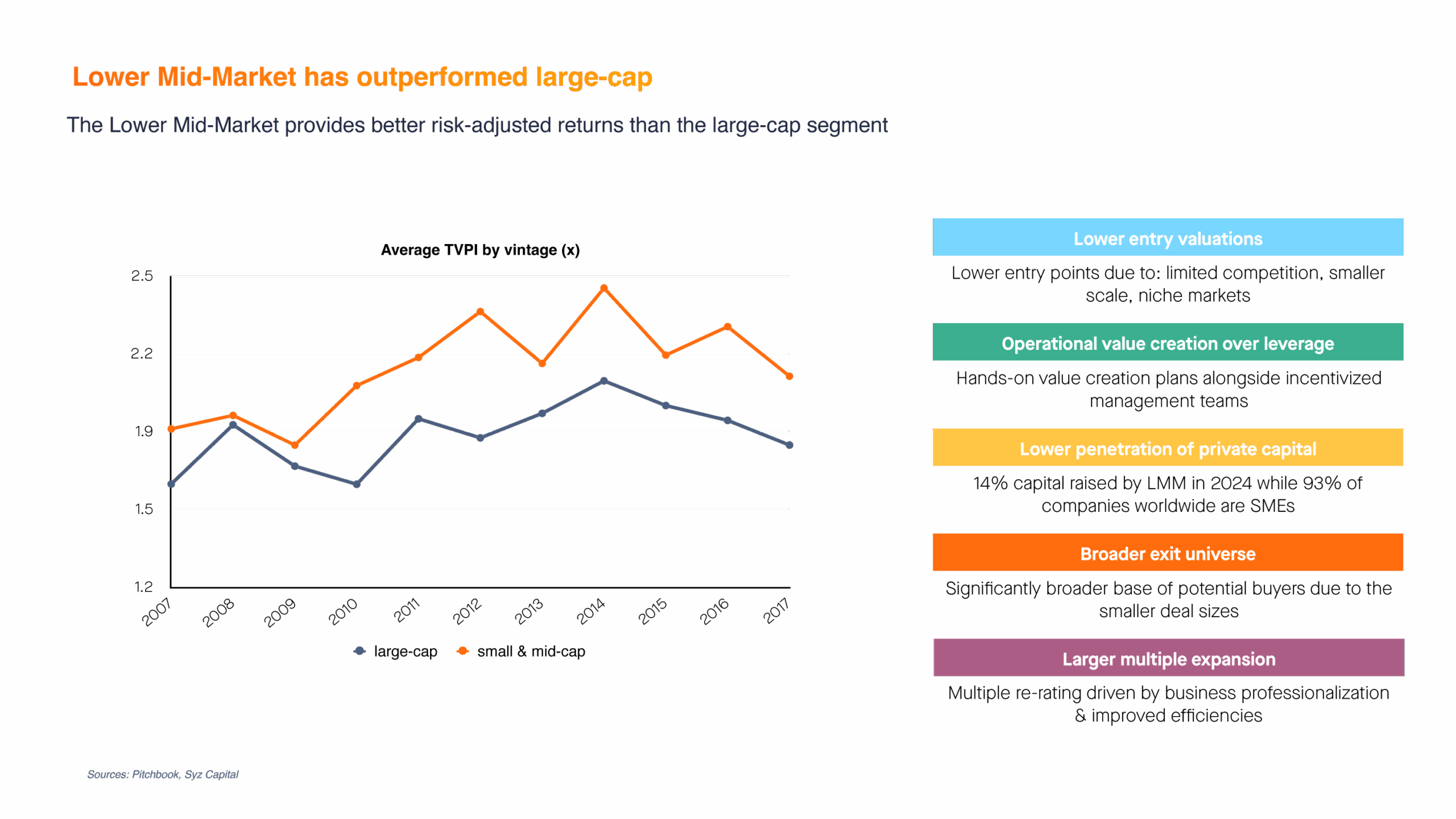

Focused primarily on Europe, our strategy targets niche sectors and companies with proven business models, compelling valuations, and actionable growth plans. This approach generates asymmetric risk-return profiles, ensuring optimized outcomes for our investors.

The portfolio emphasizes Lower Mid-Market buyouts, a segment known for resilience and high-growth potential. To enhance returns further, we incorporate discounted secondary transactions with a short, clear path to exit – creating a balanced, high-impact investment mix.

At Syz Capital, we harness our deep market relationships to co-invest alongside top-tier sponsors and management teams in high-potential Lower Mid-Market companies. Our collaborative approach ensures we identify and scale opportunities that deliver sustainable growth and returns.

We target asset-light companies with steady, predictable revenues, strong margins, and robust cash flow conversion, ensuring long-term stability and profitability.

As value investors, we specialize in uncovering hidden gems—undervalued companies with transformative growth potential at compelling entry points.

Through majority ownership and close collaboration with our partners, we provide strategic guidance and operational support to drive measurable results throughout the growth journey.

Our conservative approach to leverage safeguards investments, minimizing downside risk while maximizing long-term value creation.

At Syz Capital, we leverage our extensive network within the Private Equity community to structure discounted secondary transactions that deliver rapid investment execution, short durations, and superior risk-return profiles.

We adopt a highly flexible approach to GP-led and LP-led transactions, prioritizing real value creation over reliance on financial engineering.

Guided by our value-oriented philosophy, we specialize in acquiring discounted secondary transactions, capitalizing on attractive arbitrage opportunities.

Our secondary deals are strategically structured for quick exits and early distributions, effectively mitigating the J-curve effect while maximizing liquidity.

Through deep market relationships, we identify and secure high-quality secondary opportunities early, often in exclusive or bilateral settings.

With decades of experience, Syz Capital has cultivated a robust and exclusive network, granting us access to leading companies through partnerships with top-performing, hands-on local sponsors.

Our proprietary sourcing methodology identifies hard-to-access sponsors with unique strategies and a proven ability to outperform in their market segments.

We prioritize organic growth, operational enhancements, and multiple re-ratings as the core drivers of returns, steering clear of excessive leverage.

We align with sponsors who have a consistent track record of accelerating growth and delivering exceptional, market-beating results.

Focused on non-cyclical sectors, we adopt a conservative approach with low entry prices and minimal financial leverage to ensure strong downside protection.

We specialize in lower- and mid-market situations – where the potential for value creation is unmatched.

Project MSP is a Group pursuing a buy-and-build strategy of Managed IT Service Providers in the Netherlands. The strategy is to acquire and consolidate in one platform several MSPs offering comprehensive management of IT infrastructure and user systems on a subscription basis, focusing on a proactive, ongoing support, and maintenance.

Project Regula is a co-investment alongside AS Equity Partners into Swiss Post Solutions AG (“SPS”). The company is a global full-service provider of physical and digital document management, which provides a comprehensive suite of Document Processing and Business Process Services.

Investment Date: 2022

To behold a finely finished movement through a sapphire crystal case back is to witness a world of sublime artistry. Bridges and plates are adorned with Côtes de Genève, stripes that mimic the gentle waves of Lake Geneva, not merely for beauty but to trap dust.

Edges are bevelled and polished to a razor-sharp gleam, a testament to hours of patient work by a craftsman’s hand. Screw heads are polished and their slots perfectly aligned. Tiny jewels, synthetic rubies, are set into the movement to act as near-frictionless bearings for the pivots.

This marketing document has been issued by Syz Capital AG It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material.

This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor’s particular and individual circumstances, nor does it constitute a personalized investment advice for any investor.

This document reflects the information, opinions and comments of Syz Capital AG as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Syz Capital AG does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Syz Capital AG accepts no liability for any loss arising from the use of this document.

We are sorry that for legal reasons we are not able to help US citizens or Canadian residents other than those residing in Ontario, Quebec, or Alberta.

You chose the following profile: .

If this was a mistake, please change it here.